When acquiring another company, engaging an appraiser to conduct purchase price allocations (PPA) as soon as the transaction closes is crucial to avoid rushing the process when trying to complete an audit later.

PPAs, more formally known as the determination of purchase consideration and recognition of acquired assets and liabilities at fair value under Accounting Standards Codification® (ASC) Topic 805, Business Combinations, can require time and specialized knowledge so planning ahead is beneficial.

Learn more about PPAs so you can be in a proactive, rather than reactive, state when you need one.

Common Audit Scenarios Requiring PPAs

Imagine it’s audit season and your audit process progresses smoothly until your auditor asks about the target, a company in which you acquired a majority stake last year, as the financial results of the acquisition will have to be included in your financial statements.

This means that the price paid for the target will need to be allocated among the target’s various tangible assets, intangible assets, assumed liabilities, and goodwill.

To accomplish this, your auditor will likely advise you to find a business appraiser to perform the allocation of purchase consideration quickly so you can finalize your audit in time.

What Is a Purchase Price Allocation?

Under ASC 805, business combinations must be accounted for using the acquisition method of accounting. Under the acquisition method of accounting, all identifiable assets acquired, including goodwill, liabilities assumed, and any non-controlling interests, should be stated on the balance sheet at fair value.

Although not an allocation of the purchase price but rather a recognition of assets acquired and liabilities assumed at fair value, it’s still colloquially referred to as a PPA due to past accounting requirements.

The purpose of the PPA is to help you identify all the assets that were acquired, tangible and intangible, and the liabilities that were assumed, and recognize them at fair value.

What Does Fair Value Mean and How Is it Determined?

According to paragraph 820-10-35-2 of ASC 820, Fair Value Measurement, fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date—the closing date of the transaction.

The business appraiser determines the fair value of the asset or liability by using valuation methodologies that are generally accepted by valuation experts and auditors, and consistent with the ASC 820 concept of using an exit price that maximizes the use of observable inputs.

Tangible Assets

Certain tangible assets and liabilities require little effort on the part of the PPA provider to value, including:

- Cash

- Accounts receivable

- Accounts payable

- Some interest-bearing debt

Examples of tangible assets that require more complex valuation considerations are inventory and fixed assets, discussed in greater detail below.

Intangible Assets

Common examples of intangible assets that need to be considered in a PPA include:

- Trade names

- Trademarks

- Patents

- Know-how

- Customer relationships

- Noncompetition agreements

- Assembled workforce

An intangible asset is recognized as an asset apart from goodwill if it arises from contractual or other legal rights—regardless of whether those rights are transferable or separable from the acquired entity or from other rights and obligations.

If an intangible asset doesn’t arise from contractual or other legal rights, it’s recognized as an asset apart from goodwill only if it’s separable. That is, it’s capable of being separated or divided from the acquired entity and sold, transferred, licensed, rented, or exchanged, regardless of whether there’s intent to do so.

An intangible asset that can’t be sold, transferred, licensed, rented, or exchanged individually is considered separable if it can be sold, transferred, licensed, rented, or exchanged in combination with a related contract, asset, or liability.

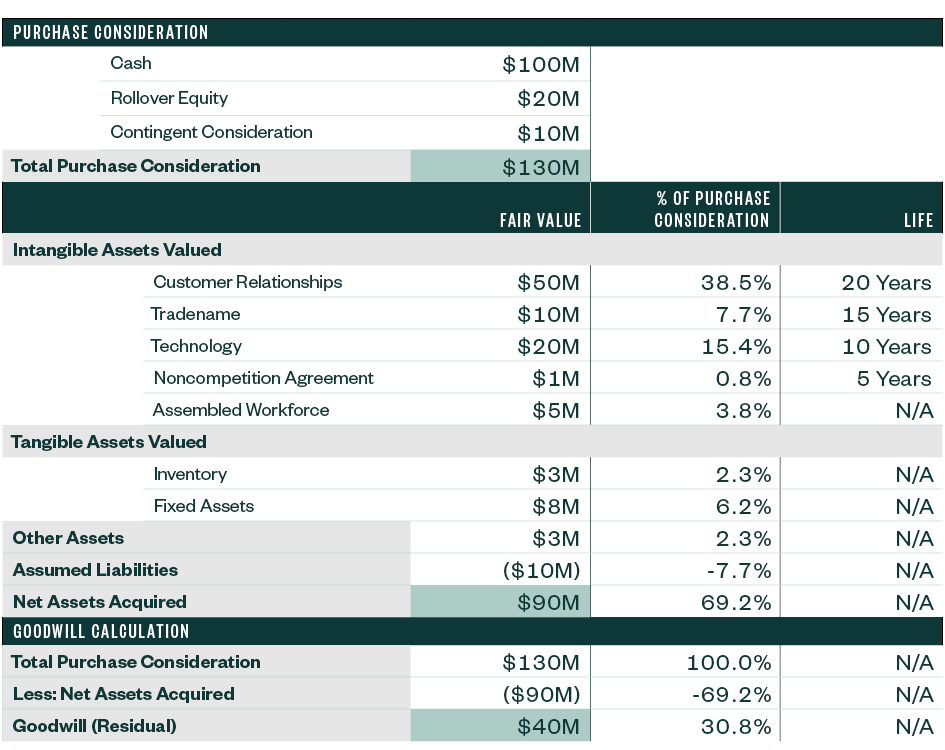

The below example demonstrates what a summary exhibit for a PPA may look like.

The example plainly identifies the total purchase consideration and its various components, each intangible and tangible asset or liability, their respective fair values, and life. The buyer will use the fair value figures to recognize the assets and liabilities and prepare the consolidated financial statements.

Why Might My Company Need a Purchase Price Allocation?

Looking back to the discussion on ASC 805, you will most likely need a PPA if you recently completed a business combination and you have audited GAAP-basis financial statements.

In this case, engage a PPA provider immediately after the closing of the transaction so the work can be completed before your audit begins. If you find yourself needing a PPA during your audit, it will likely be more difficult to find a provider that has capacity to do the work. Even if you can find one, it will likely be more costly.

Additional Factors to Consider

There are several factors that can affect the complexity of a PPA.

The Private Company Alternative—ASU 2014-18

Private companies that choose to adopt the private company alternative will no longer recognize, or otherwise consider the fair value of, certain customer-related intangible assets or those attributable to noncompetition agreements acquired in business combinations and certain other qualifying transactions.

Instead, these amounts will be included as a part of goodwill. Private companies that adopt the alternative may benefit from cost savings, since it eliminates the need to:

- Separately recognize certain customer-related intangible assets and noncompetition agreements

- Conduct impairment testing of such assets in future periods

It also makes the PPA less complicated and therefore less costly. If adopted, the alternative would constitute an accounting policy change that requires prospective application to all future transactions after the adoption date.

This alternative also requires that goodwill is amortized over a period of 10 years, or alternative life if supported.

Inventory

Fair value adjustments to inventory have the potential to be material, especially if the target manufactures a product and holds a large quantity.

Discuss materiality level with your auditor and work with your PPA provider to understand whether determining the fair value for the inventory will be meaningful to the PPA exercise or not.

The following factors will typically lead to a larger fair value inventory adjustment:

- Margins on the sale of your finished goods inventory are high

- Costs to complete work-in-process inventory as of the measurement date are low

- Inventory can be disposed of quickly once it becomes a finished good

- Costs to dispose of the inventory are low, for example, quantity discounts, sales commissions, freight, and shipping charges

Fixed Assets

Be careful not to overlook the target’s fixed assets as fair value will most likely be different than historic book value, and in some situations significantly different.

Experts generally recommend valuing the fixed assets if any one of the following applies:

- They are a material percentage of the purchase price

- The fixed assets are a critical part of the target’s business; for example, a manufacturing company

- You believe historic book value is materially different from fair value

Your PPA provider may have the necessary skills and expertise to also perform the valuation of fixed assets, but real estate or asset specific valuations are typically performed when the amounts are likely to be material.

What Is Rollover Equity?

Sometimes it’s in the buyer’s or seller’s best interest for the seller to maintain ownership in the combined entity. When this occurs, it’s referred to as rollover equity. When rollover equity is present the PPA provider will consider whether it needs to be adjusted to fair value.

Below are some examples of circumstances when the rollover equity value could need to be adjusted to fair value:

- The shares received by the seller have different economic rights than the shares held by the majority owner

- The shares received by the seller aren’t allowed to vote on matters requiring a vote

- The shares received by the seller have transfer restrictions

If any of these factors are true, it’s likely additional analysis will have to be performed to determine the fair value of the rollover equity.

Contingent Consideration

When contingent consideration, also known as earnouts, is part of a purchase agreement, its fair value needs to be factored into the purchase price. This can increase goodwill. In the above example, had the contingent consideration been ignored, the purchase consideration and goodwill would have been understated by $10 million.

The valuation of contingent consideration is often complex requiring the use of sophisticated methodologies including option-pricing modeling.

We’re Here to Help

To learn more about PPAs or to begin the process, contact your Moss Adams professional. You can also visit our Valuations Services or Technical Accounting Services for additional resources.